BENGALURU: Social game developer Zynga reported 3.5 per cent YoY drop in GAAP revenue at $185.77 million for the quarter ended 31 December 2015 (Q4-2015, current quarter) as compared to $192.55 million. Adjusted EBIDTA for the current quarter dived 82.4 per cent YoY to $1.66 million (0.9 per cent margin) as compared to $9.43 million (4.9 per cent margin).

For the year ended 31 December, 2015 (FY-2015, current year), GAAP revenue increased 11 per cent to $764.72 million from $690.41 million, adjusted EBIDTA declined 57.1 per cent to $17.13 million (2.2 per cent margin) from $39.93 million (5.8 per cent margin).

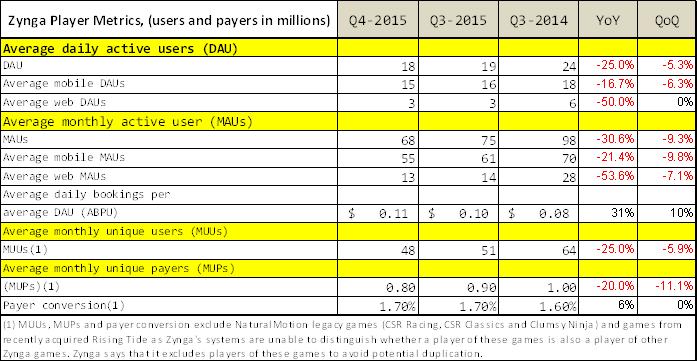

Average Daily Active Users (DAU), Average Monthly Active Users (MAUs), Average Monthly Unique Users (MUUs) in Q4-2015 declined YoY and QoQ. The silver lining was that Average Bookings Per User (ABPU) and payer conversions increased. Bookings in the current quarter were almost flat (declined 0.1 per cent) to $182.10 million as compared to $182.35 million, while bookings in the current year increased 1 per cent to $699.96 million as compared to $694.3 million in the previous year. Please refer to the figure below for player matrices.

Zynga CEO and founder Mark Pincus said, “”In terms of our financial scorecard, for 2015, we made good progress in our transition to mobile on a bookings level but, due to the lack of significant new releases, we saw an overall decline in our audience. While our total bookings grew 1 per cent, our core live mobile franchises – Slots, Words With Friends and Poker – were up 63 per cent and all of mobile grew 35 per cent. We ended the year with mobile now representing 73 per cent of total bookings up from 60 per cent in Q4-2014. We saw our web business continue to decline with bookings down 32 per cent and audience down 53 per cent. Overall for the year, we managed to support a relatively large slate of new game development and user acquisition while remaining profitable.”

“Our mobile audience was down 1 per cent in 2015. Within the quarter, it was down sequentially by 5 per cent driven by a lack of significant new releases. However we’ve stemmed these declines for our core live mobile franchises – Slots, Words With Friends and Poker – which were up 1 per cent for the quarter versus a loss of 6 per cent in Q3. This was led by Slots, which accelerated its audience growth rate from 6 per cent in Q3-2015 to 15 per cent in Q4-2015. Words With Friends moved from a loss of 7 per cent in Q3-2015 to flat in Q4-2015 and a 9 per cent increase in the beginning of Q1-2016. Poker has moved from a 10 per cent decline in Q3-2015 to a 4 per cent decline in Q4-2015 and has flipped to positive growth of 12 per cent in the beginning of Q1-2016,” Pincus continued.

“For 2016 and beyond, growth and profits will be driven by our ability to continue our momentum with live franchises and execute on new game launches. While we get that Zynga has been a show me story, in 2016, we have better visibility into our slate than ever before, with 6 new games already in soft launch. While we have high conviction in our ability to launch these games, the biggest challenge will be delivering on long-term retention and the LTV to support user acquisition at scale,” said Pincus.

“We expect to launch 10 new games in 2016. In Social Casino in the first half of this year, we plan to launch Spin It Rich!, Willy Wonka Slots, True Vegas and Vegas Diamond Slots. In Match-3, we expect to launch 2 new games in the first half of this year with Zindagi’s Crazy Cake Swap and a branded game leveraging the Wizard of Oz license. In Invest Express, we expect to launch a sequel to FarmVille 2: Country Escape as well as CityVille Mobile in the second half of 2016. Finally, in Action Strategy, we also expect to launch CSR2 and Dawn of Titans in the second half of the year. As we exit the year with this slate of new games launched and in the market, we expect to have changed our mix of R&D and unlaunched slate to live, revenue generating games which will improve our company’s predictability, profitability and growth,” stated Pincus.