The world is currently undergoing a harrowing and unprecedented event: the COVID-19 pandemic. During these trying times, gaming has become a means of escapism and time filling for many.

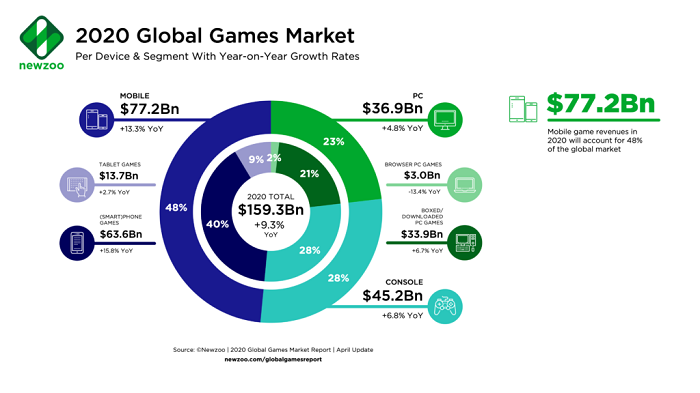

As a result, one of this year’s growth drivers is an increased interest in gaming due to COVID-19-related lockdown measures. However, the launch of the next-generation consoles toward the end of the year is also a key contributing factor. According to Newzoo report published by Sr Market Analyst Tom Wijman, 2020’s global games market will generate revenues of $159.3 billion, healthy year-on-year growth of +9.3per cent.

All game segments saw an increase in engagement and revenues as a result of the COVID-19 measures, but mobile gaming saw the biggest increase. In total, mobile games will generate revenues of $77.2 billion in 2020, growing +13.3 per cent year on year.

There are a few reasons why mobile will attract more growth than both PC and console gaming:

- Mobile gaming has the lowest barrier to entry: more than two-fifths of the global population owns a smartphone—and many mobile titles are free to play.

- Mobile gaming as an alternative to PC cafes: the closure of these cafes has led many to (temporarily) churn to mobile gaming.

- The mobile development process is less complex and, therefore, less likely to suffer delays from COVID-19-related disruption.

- Expected engagement for mobile games to rise even more rapidly. After all, it is infamously difficult to convert players into payers on mobile. Overall, there will be 2.6 billion mobile gamers in 2020; of which, just 38 per cent will pay for games.

Meanwhile, console gaming will grow +6.8per cent year on year to $45.2 billion, boasting over 729 million players. Engagement and revenues are set to grow due to the lockdown measures, at least in the short term, but COVID-19 is also having negative effects on console gaming.

Physical distribution, massive cross-company collaboration, and certification are a major part of console game development, which may result in game delays in the future or games scaling down scope or features to hit release windows.

In Q2, PlayStation 4 exclusives The Last of Us 2 and Ghost of Tshushima were already delayed due to distribution issues (resulting from the pandemic). Even ported games are affected, with Switch ports of The Outer Worlds and The Wonderful 101: Remastered also receiving COVID-19-related delay

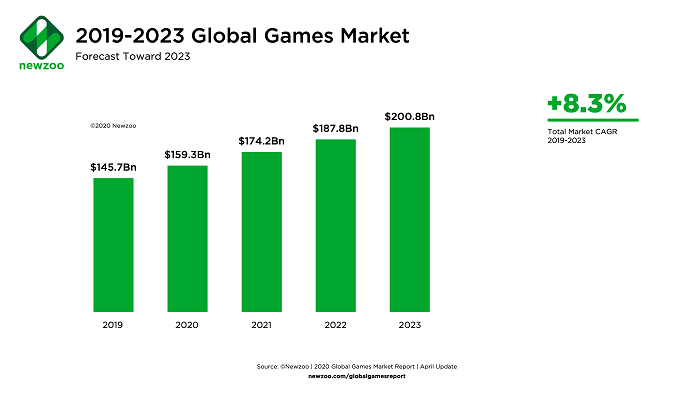

Growth in the console market has slowed down significantly compared to the heights it reached in 2018. Anticipation for the next-gen consoles already led to lower-than-expected spending on console last year. Due mostly to this, we adjusted our 2019 global games market estimate to $145.7 billion.

While there is a short-term uplift this year due to the lockdown measurements, the next-gen consoles and associated content are essential to kickstart a new phase growth in that segment.

Finally, PC gaming, driven by its 1.3 billion players, will grow +4.8 per cent year on year to $36.9 billion in 2020. This growth can be almost fully attributed to the lockdown measures. Unlike console gaming, new releases for PC rarely reach revenues that significantly change the market’s outlook.

Many of PC’s most popular games have been at their respective positions for at least three years, with some retaining popularity for over a decade.

On the other hand that according to research and market report Global Gaming Industry: Growth, Trends and Forecast 2020-2025, the global gaming industry is expected to register a CAGR of 12per cent during the forecast period 2020-2025. The report shares:

- The collision of blockchain technology and gaming holds great promise for the growth of industries. Blockchains provide a useful tool for gamers for various reasons including decentralized asset exchanges, verifiable scarcity of virtual objects and collectibles, fast and secure payment networks, and ability for developers to properly monetize their creations.

- Though people have been talking about it for years now, it is now inevitable that virtual reality will become a major cornerstone piece of the gaming industry. By 2020, players will spend USD 4.5 billion on immersive gaming. It is 20 times more enjoyable and convenient than traditional alternatives. Companies like BigScreenVR and AltSpaceVR are two of the leaders in this industry today, accelerating a virtual future perhaps faster than many expect. market.

- Rising internet penetration is driving the demand of the market. The number of people with access to the internet in emerging markets has grown dramatically in the past years, due to the global expansion of Chinese smartphone manufacturers offering affordable smartphones and local government investment in mobile internet infrastructure. GlobalWebIndex’s data also indicates that more than 1 billion people around the world now stream games over the internet each month. The latest numbers indicate that almost a quarter of all internet users, more than 1 billion people watch livestreams of other people playing games each month.

- Platforms such as e-sports betting and fantasy sites have attracted more investments, which is driving the market. Approximately one-third of the e-sports fans in the United States (SPY) participate in online amateur tournaments. Because there is immense potential in this segment, Activision (ATVI) and Electronic Arts (EA) are looking to increase market penetration. Asia and Europe remains a huge market for these companies.

- However, issues such as piracy, laws, and regulations, and concerns relating to fraud during gaming transactions are expected to hamper market growth, which is a key restraint for the market.

Console segment to witness significant growth

The most recent trend is the growing availability and popularity of multi-functional gaming console, which is emerging in the market and helping in growing the market of video games globally.

A video game console is an interactive entertainment computer or modified computer system that produces a video display signal which can be used with a display device (a television, monitor, etc.) to display a video game. The PlayStation 4 Pro is the best version of the most popular game platform available today. With 4K, HDR 10 compatibility, and the PlayStation 4’s exclusive game library, it is currently the best plug-and-play gaming platform which predicts more revenue generation in future in video game console segment.

Coming to new innovation, in Sep 2019, NEOGEO Arcade Stick Pro Merges both Game Console and Controller in one part where the controller also comes with start/select buttons, a turbo switch and ports for HDMI and USB. This new innovation will help the user to penetrate more on the console segment due to its unique features.

Video gaming in China is a massive industry and pastime that includes the production, sale, import/export, and playing of video games. China is the largest, highest grossing and the most profitable video game market in the world, since 2015. In esports, China has been the world leader in terms of tournament winnings, possessing some of the best talents in the world across multiple video games, as well as one of the largest pool of video gamers. As of 2017, half of the top 20 highest earning esports players in the world are Chinese.

Due to adoption of esports, the increase of video game through console is increasing and will accumulate more growth in the future.

Asia-Pacific Holds the largest market share

Asia-Pacific hold the largest market share, where Southeast Asian holds the largest revenue. The online population in Southeast Asia (SEA) is rapidly rising, mostly due to an increase in mobile-device use and almost two thirds of the gaming population in Greater Southeast Asia are engaged in esports. Owing to this, the region is also the fastest-growing games market in the world.

While companies from all over the world are vying for a piece of the SEA gaming pie, the region’s top publisher is local player Sea Group (formerly known as Garena). The company is best-known for publishing Tencent’s titles in SEA.

Moreover, South Korea-based Gravity, a subsidiary of GungHo, has doubled down on SEA, investing heavily to promote its portfolio in the region, particularly the Ragnarok franchise.

Also various new platforms are being generated to enhance the Aisa-Pacific growth. For instance, in Sep 2019, industry-leading casino content developer Betsoft Gaming announced that they will roll out a suite of highly innovative slot games specifically designed for the Asian market.

Asia-Pacific is soon becoming the hub for many pilot projects of gaming companies. For instance, in March 2019, Tencent launched a website for the cloud gaming platform called Start and invited people in Shanghai and Guangdong, China to sign up for the test.

Japan has been setting trends in gaming since the advent of the industry. It developed the consoles that shifted video games into the mainstream and pioneered a number of foundational genres, franchises, and studios. Esports and MMO games are the obvious future of the video game industry, and Japan is starting to change the way it approaches both to maintain its position as a gaming heavyweight.

Competitive Landscape

The gaming market is fragmented as the demand for online games and increasing penetration of mobile applications across the US, the UK, Italy, and China and SAR region will help attract new players in this market over the next few years. Key players are Sony Corporation, Microsoft, Nintendo, and more.

Here is a brief on the movement in stock prices, and their outperformance vis-a-vis broader markets

Activision Blizzard (11.6 per cent YTD return, $51 billion market cap): Activision Blizzard has been doing well with its Call of Duty: Modern Warfare, which was released in November 2019, and it is currently the top-selling game of 2020. The game garnered sales of over $1 billion within one month of its launch, and with the latest rankings placing it at top spot thus far in 2020, will likely bolster Activision Blizzard’s Q1 2020 revenue growth. Activision earned an adjusted 58 cents a share on net bookings of $1.52 billion in the first quarter. Analysts expected Activision earnings of 38 cents a share on sales of $1.32 billion. On a year-over-year basis, Activision earnings rose 87per cent while sales climbed 21 per cent.

Electronic Arts (6.5 per cent YTD return, $33 billion market cap): Electronic Arts, after seeing a bad fiscal 2019, appears to be back on a growth track. It struggled in fiscal 2019 due to lower user engagement for some the company’s games, including Battlefield and Need for Speed franchises. However, thus far in fiscal 2020, the company has posted low double-digit top line growth, led by growth in Apex Legends, Star Wars, and FIFA franchises. EA earned an adjusted $1.08 a share on net bookings of $1.21 billion in its fiscal fourth quarter ended 31 March. Wall Street was modeling EA earnings of 98 cents a share on sales of $1.19 billion. However, on a year-over-year basis, EA earnings fell 18per cent while net bookings dropped 11 per cent.EA stock ranks first out of 13 video game stocks in IBD’s Computer Software-Gaming industry group, according to the IBD Stock Checkup tool. That group ranks No. 16 out of 197 industry groups tracked by IBD.

Zynga (21.7 per cent YTD return, $7 billion market cap): Zynga is a relatively small company, but it has given better returns over the recent past. The company’s strategy of growth through acquisitions has paid off, thus far. Over the recent years, it acquired gaming portfolios of Gram Games and Small & Giant games, and they are doing well with increased user engagement for Merge Dragons!, and Empires & Puzzles. The company is expected to launch multiple new games in 2020. Last month, it released Harry Potter: Puzzles & Spells, and these new games will likely aid the top line growth.

Take Two Interactive (1.7 per cent YTD return, $14 billion market cap): Take-Two Interactive’s NBA2K20, and Grand Theft Auto V are among the top 10 selling games of 2020. The company plans to make significant investments toward development of new games, amid the launch of newer generation consoles.

YOOZOO annual report shares a 10.07 per cent YoY decrease in revenue to $453.7 million. The decline in performance is attributable to a combination of delayed new product launches, substantially increased advertising costs and written-down receivables and share holdings in other companies. Meanwhile, the company saw its net operating cash flow rise 101.38per cent to $77 million.In the first quarter of 2020, YOOZOO saw robust growth in its main business, with a 45.5 per cent YoY increase in revenue to $170 million and a 110.14per cent YoY increase in net income (compared with 80 per cent for the previous quarter), according to its quarterly report released on the same day.

Check out shobet